In a financially chaotic world, managing money effectively remains crucial. Looking ahead to 2023, smart budgeting is easier than ever, thanks to digital tools. With numerous apps available at your fingertips for every device imaginable, it’s simple to keep track of finances from the palm of your hand daily. These ten top-rated options are some of the best budget apps lined up for an economically sound future in 2023.

1. Rocket Money

Rocket Money, formerly known as Truebill, boasts a rich history of assisting over 3.4 million users globally in honing their budgeting skills. But what sets Rocket Money apart is its bill negotiation service, a feature designed to help users cut down monthly expenditures. Whether monitoring spending in poker cash games or tracking the weekly grocery bill, Rocket Money is a superior resource.

The app offers an immediate snapshot of financial patterns by automatically tracking and categorizing expenses. Optional enhanced features, like bill negotiation, position it as a top contender among budgeting apps, particularly for individuals eager to streamline their monthly outgoings.

2. Zeta

Zeta is known for its uniqueness in the market, especially aiming at couples and families. This financial application acts as an effective tool to manage shared expenses within households while giving individuals sovereignty over their personal budgeting.

Users also benefit from the built-in messaging tool, providing an easy communication channel about finances. Plus, with data encryption and two-factor authentication, Zeta prioritizes the security of its users’ data.

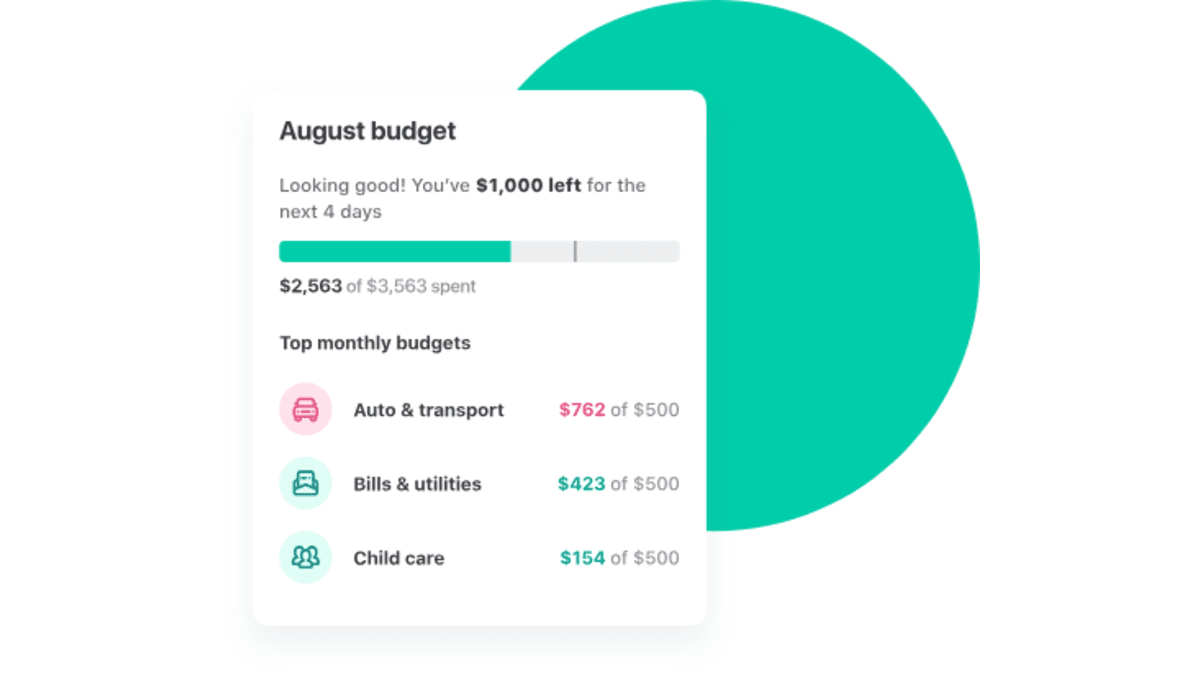

3. Mint

Mint is recognized as a prominent force, boasting over 30 million users in the budgeting app space. Its key allure lies in providing an all-encompassing view of personal finances; amalgamating data from bank accounts, credit cards, and loans to investments enables users to effectively navigate their financial landscape.

This clear financial snapshot, complemented by Mint’s transaction categorization and personalized insights, enables users to efficiently strategize savings, debt payments, and other financial goals.

4. PocketGuard

With a focus on debt repayment, PocketGuard ensures users budget efficiently and strategize their debt payoff. The app’s hallmark is its tailored debt payoff plans. Users simply input their debt balances and interest rates, and PocketGuard crunches the numbers to present the most efficient repayment method.

Add to this the bill reminders, fee alerts, and savings goal tools, and it’s clear why PocketGuard has garnered attention. Its computer version is an added boon for those keen on desktop budgeting.

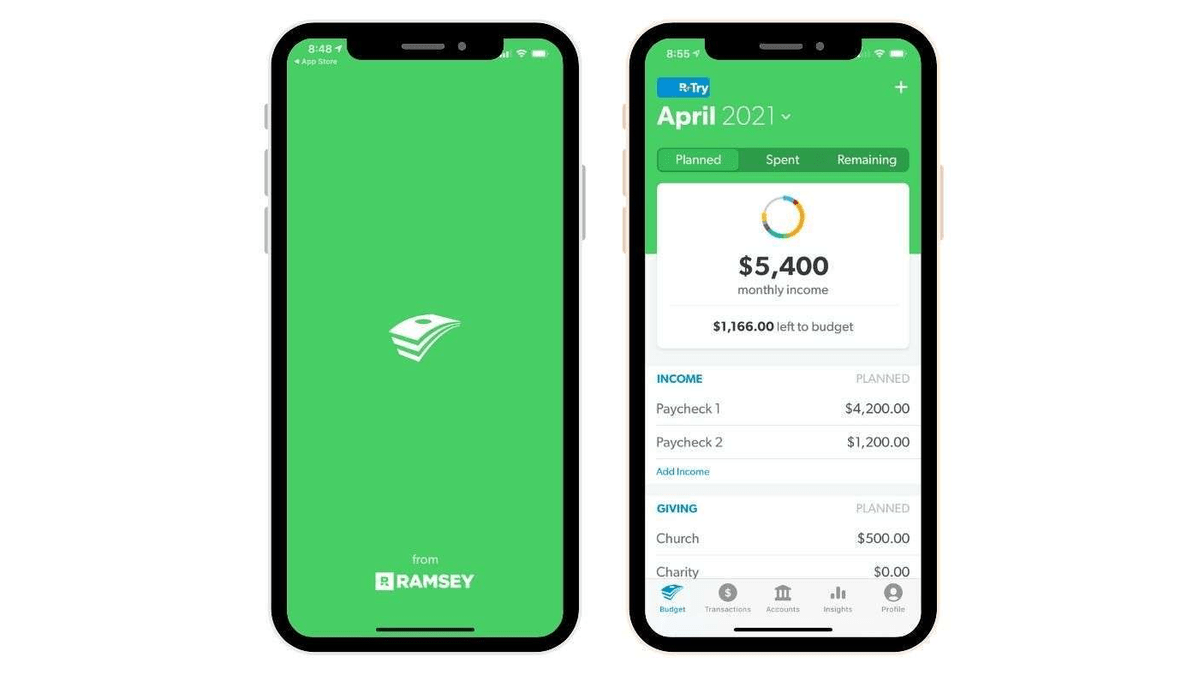

5. EveryDollar

EveryDollar makes the process of creating customized budgets and setting financial milestones effortless. While the app provides robust features in its basic version, the premium counterpart amplifies the experience with perks like bank connectivity and group financial coaching.

Despite its array of features, EveryDollar retains a user-centric approach, suggesting that individuals should turn to the desktop version for optimal usage.

6. Honeydue

Honeydue stands out by directing its focus toward couples. This free platform empowers couples to manage both their shared and individual finances harmoniously. With support from thousands of financial institutions across multiple countries, Honeydue’s versatility is commendable.

Beyond budgeting, the app’s chat feature fosters financial communication between partners, ensuring transparency and alignment in money matters. Moreover, Honeydue offers a joint bank account backed by FDIC insurance.

7. Wally

Exclusive to iOS users, Wally is not just another budgeting app – it’s a financial companion that offers users a vivid view of their financial journey. Key features such as customizable budgets, progress trackers, and financial calendars enable users to grasp their monetary habits and future aspirations.

Wally’s global outlook distinguishes it. The app caters to those who often traverse borders, allowing the management of foreign bank accounts from over 70 countries.

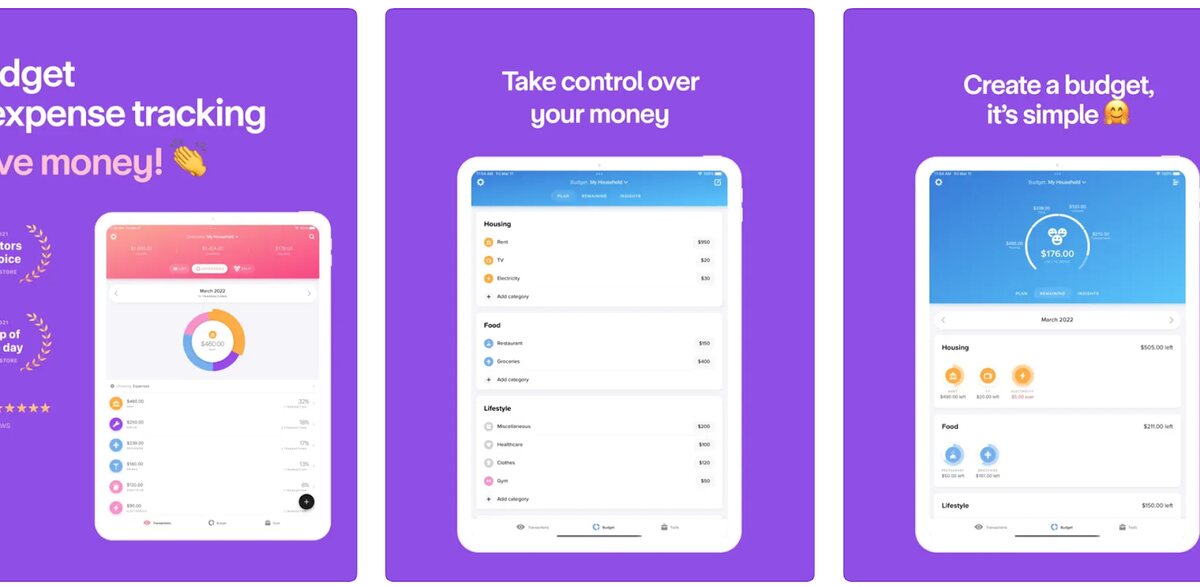

8. Buddy

Simplifying shared expenses, Buddy emerges as the go-to mobile budgeting app for those who often split bills with friends or family. Its core functionality extends beyond personal expense tracking to facilitating the fair division of shared costs.

Users’ ease of navigating joint expenditures ensures transparency and fairness, reducing potential financial disagreements among peers. Despite being mobile-only, Buddy doesn’t compromise on quality – boasting one of the highest app ratings in its category.

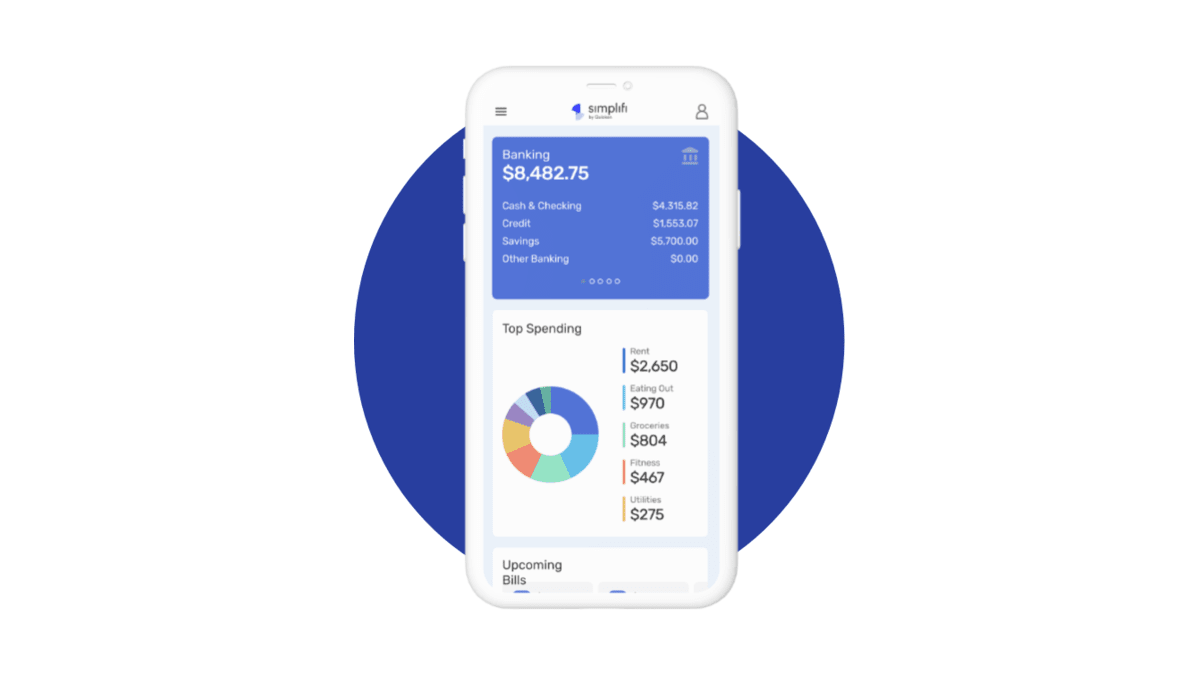

9. Simplifi

Hailing from the respected stable of Quicken, Simplifi takes a comprehensive approach to budget management. It isn’t merely about tracking monthly expenses; the app delves deep into the financial intricacies of debt repayment, investments, and tax planning.

Its ad-free environment ensures a distraction-less experience. While its mobile app rating might lean towards the modest side, the desktop variant provides a richer, more immersive experience.

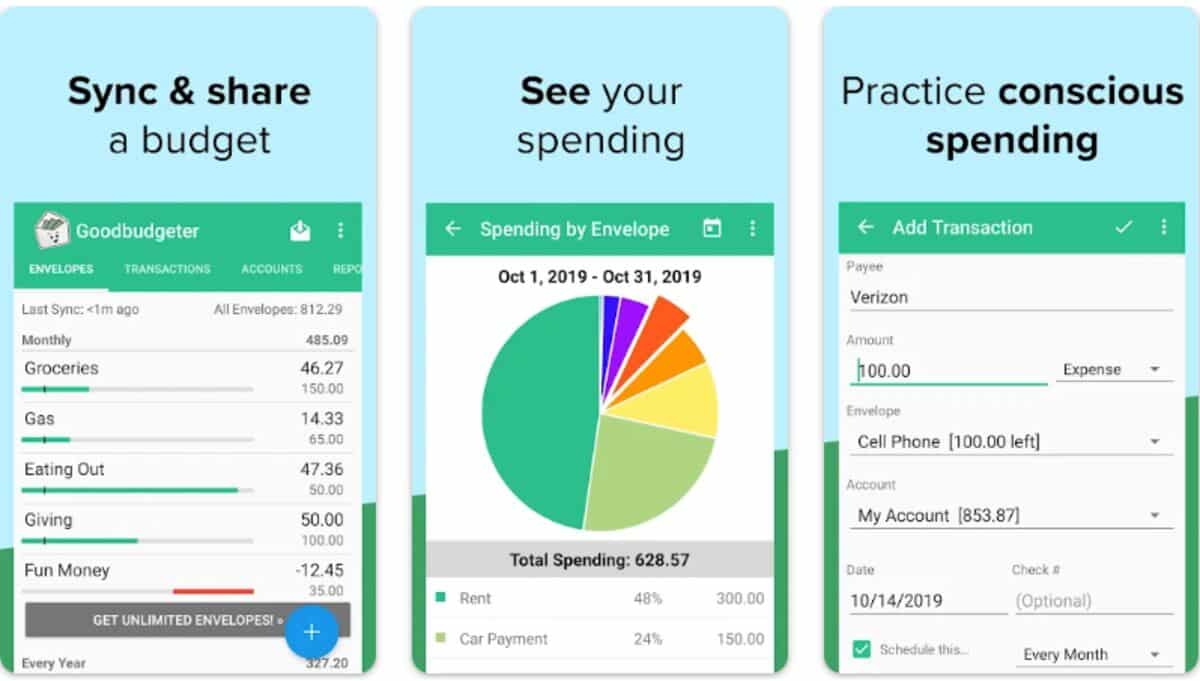

10. Goodbudget

Evolving from a virtual envelope budgeting method, Goodbudget has grown to offer a full-fledged budgeting platform. Founded in 2009, it combines traditional budgeting wisdom and modern digital convenience.

Its unique selling point is enriching the user experience through educational resources. Whether it’s podcasts, articles, or online courses, users need to be given the tools to manage their finances and the knowledge to navigate financial complexities. The absence of account syncing might be seen as a limitation by some.

Conclusion

Leveraging the right budgeting app can transform one’s financial well-being. From globally-oriented tools like Wally to education-focused platforms like Goodbudget, there’s an app tailored to fit every unique monetary need. As we venture into 2023, these applications promise to simplify financial management, encourage sound financial habits, and ensure that users are not just spending but also learning.