6 Reasons you may get declined from using Klarna

If your application for a Klarna card was declined, there are several reasons that could have caused that. We’ll look at the reasons in this article.

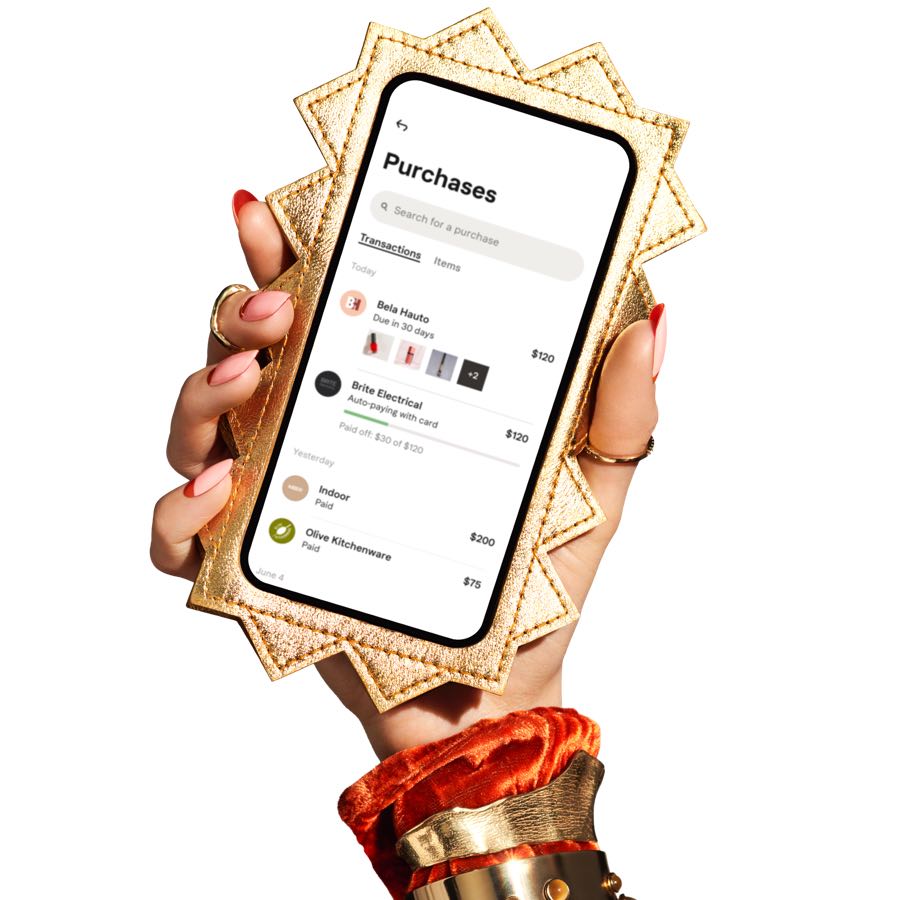

Klarna is a popular payment platform that offers consumers a variety of payment options for online and in-store purchases. The company has gained a lot of popularity due to its “buy now, pay later” service, which allows customers to split their payments into installments. However, not everyone who applies for Klarna’s services is approved. In this blog post, we’ll discuss the reasons why you may get declined from using Klarna.

Why Klarna may decline your application

1. Poor Credit Score

One of the primary reasons why you may get declined from using Klarna is if you have a poor credit score. Klarna conducts a credit check on all its customers before approving them for any services. If you have a history of missed or late payments, or if you have a high level of debt, it may negatively affect your credit score and reduce your chances of being approved.

2. Insufficient Income

Klarna also considers your income when evaluating your application. If your income is not sufficient to support the amount of credit you are applying for, you may be declined. Klarna wants to ensure that its customers have the ability to repay the debt they incur, so they look at your income to determine whether you are a good candidate for their services.

3. Age Restrictions

Klarna has age restrictions on its services, and you must be at least 18 years old to use them. If you are younger than 18, your application will be declined.

4. Incorrect Personal Information

Another reason why your application for Klarna’s services may be declined is if you have provided incorrect personal information. This could include your name, address, or date of birth. If any of this information is inaccurate, it may negatively affect your credit check and reduce your chances of being approved.

5. Previous Payment Issues

If you have had previous payment issues with Klarna, such as missed payments or late payments, this may negatively affect your chances of being approved for future services. Klarna takes payment history seriously and may decline your application if they feel that you are not a reliable borrower.

6. Fraudulent Activity

Finally, Klarna may decline your application if they suspect any fraudulent activity. This could include using false information or attempting to use someone else’s identity to apply for their services. Klarna takes security seriously and may decline any applications that raise suspicion of fraudulent activity.

Final Words

In conclusion, Klarna offers a great service for those looking for flexible payment options. However, there are several reasons why your application may be declined, including poor credit score, insufficient income, age restrictions, incorrect personal information, previous payment issues, and fraudulent activity. If you have been declined, it’s important to understand why and take steps to improve your credit score or address any issues that may be holding you back.

To get our latest news once they’re published, please follow us on Google News, Telegram, Facebook, and Twitter. We cover general tech news and are the first to break the latest MIUI update releases. Also, you get issues-solving “How To” posts from us.